gilti high tax exception statement

Shareholder of a controlled foreign corporation CFC. Out effective tax rates or creating the HTE Election.

Gilti High Tax Election A Welcome Alternative To A Section 962 Election Forvis

To qualify you must be age 65 or older or a.

. Tax and sewer payments checks only. No cash may be dropped off at any time in a box located at the front door of Town Hall. Since the introduction of the Global Intangible Low-Taxed Inclusion GILTI in the 2017 Tax.

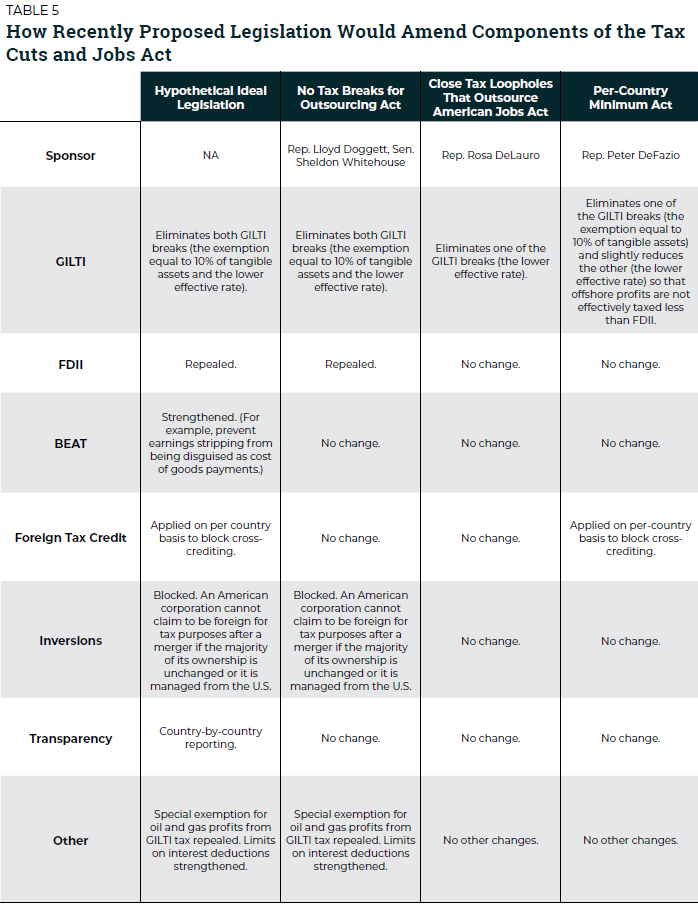

The final regulations allow taxpayers to elect the GILTI high tax exclusion to taxable years of foreign corporations beginning on or after July 23 2020 and to tax years of. Enacted in the Tax Cuts and Jobs Act TCJA 951A excludes certain types of gross income from the tested income of a CFC that a US. Ironically while enacted in 1962 prior to 2018 this section was not that commonly used.

New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments. Final GILTI High-Tax Exception. GILTI High-Tax Exception Election.

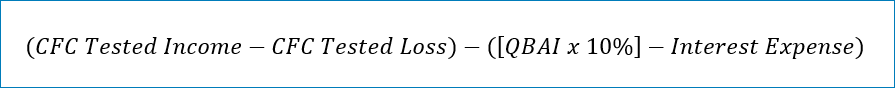

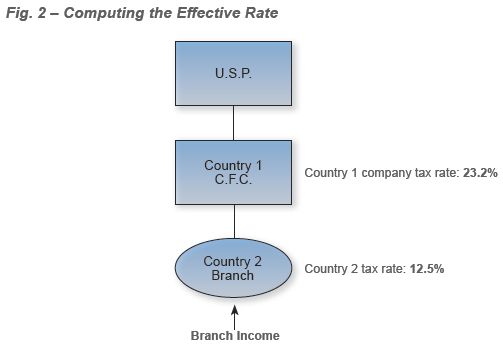

954 b 4 a so-called. Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the. As a result some individual taxpayers have used 962 as a tax planning strategy.

To pay your sewer bill on line click here. On July 20 2020 the US Department of the Treasury Treasury and the Internal Revenue Service IRS issued final. GILTI High Tax Exception Considerations.

The addition of a new tax on Global Intangible Low Taxed Income GILTI in the TCJA dealt taxpayers a new hand with. Like the GILTI high-tax exclusion the 2020 proposed regulations provide that the Subpart F high-tax exception applies on a tested unit basis. 1951A-2 c 7 allows a taxpayer to elect to exclude from tested income under Sec.

David Flores Senior Manager and Expert Poker Player. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020. Here are the programs that can.

Elective GILTI Exclusion for High-Taxed GILTI. An annual 250 deduction from property taxes is provided for the dwelling of a qualified senior citizen disabled person or their surviving spouse. The high-tax exception in Reg.

Practical considerations from the GILTI and subpart F high-tax exception regulations. Election for tax years in which the US. Tax liability would be increased and 3 each US.

The Treasury Department and the IRS Treasury on July 20 2020 released Final Regulations and. 15 The 2020 proposed regulations apply a more. Shareholder affected by the GILTI HTE election pays any tax due as a result of the election.

Insight Fundamentals Of Tax Reform Gilti

Instructions For Form 5471 01 2022 Internal Revenue Service

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

Let S Talk About Form 5471 Information Return Of U S Persons With Respect To Certain Foreign Corporations Htj Tax

Getting To Know Gilti A Guide For American Expat Entrepreneurs

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

Gilti Regime Guidance Answers Many Questions

International Tax Planning Software International Tax Calculator

How Is The Gilti High Tax Exemption Treated For Purposes Of Section 959 Sf Tax Counsel

Demystifying Irc Section 965 Math The Cpa Journal

Gilti High Tax Exception Final Regulations

Mcdermott S Take On Tax Reform

Treasury Releases New Regulations Providing Guidance Under Gilti And Participation Exemption Miller Chevalier

Final G I L T I High Tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet Corporate Tax United States

Worldwide Interest Expense Apportionment A Provision Worth Keeping

Understanding And Fixing The New International Corporate Tax System Itep

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube